Regional teams

Strategies are driven by small teams at a regional level to capitalise on the best opportunities.

Global leadership

Since 2023, J O Hambro is part of Perpetual Limited, a global leader in multi-boutique asset management.

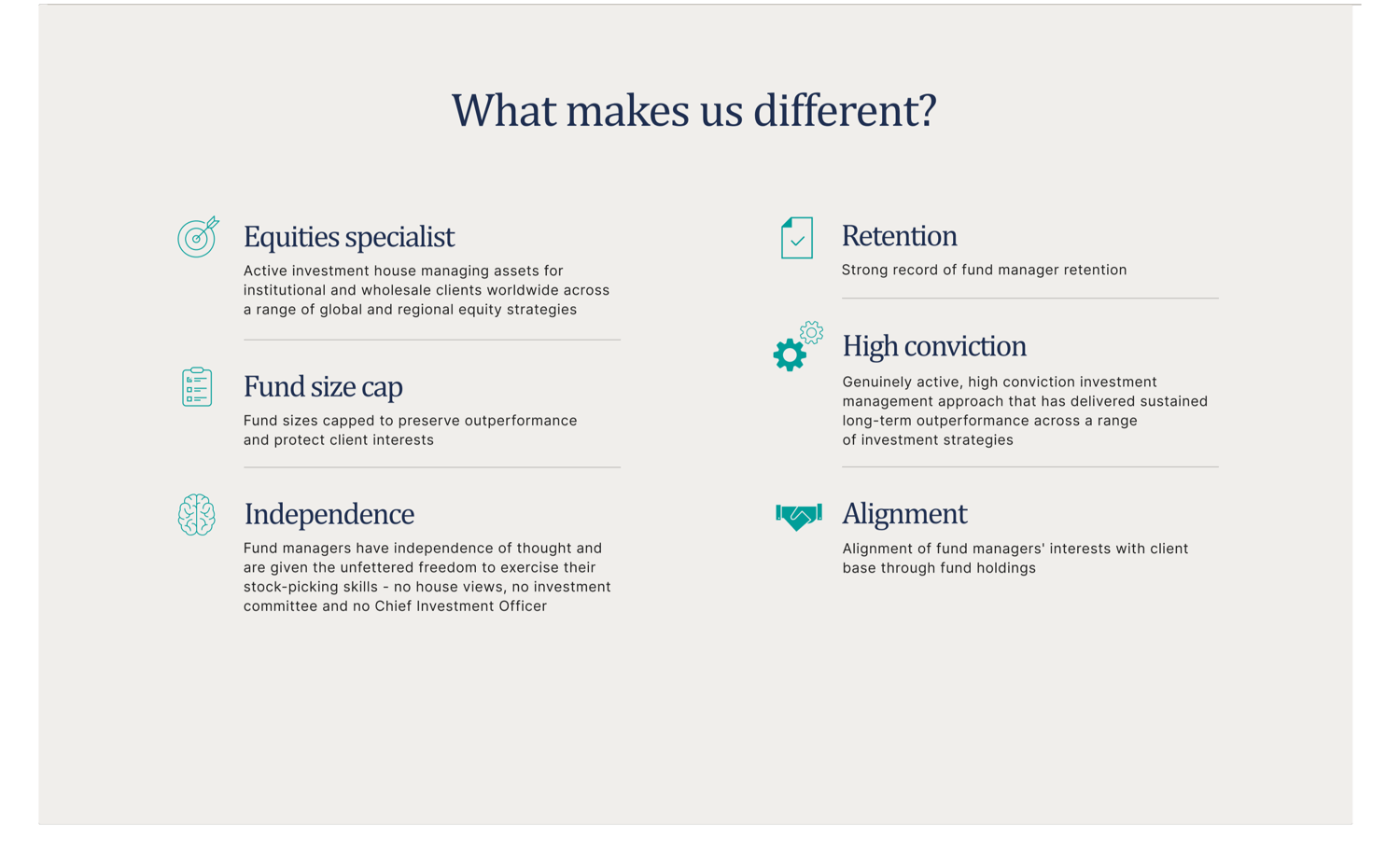

J O Hambro Capital Management is an active, equities-specialist investment boutique managing assets for clients worldwide across a range of global and regional strategies.

Strategies are driven by small teams at a regional level to capitalise on the best opportunities.

Since 2023, J O Hambro is part of Perpetual Limited, a global leader in multi-boutique asset management.

Founded in 1993, J O Hambro Capital Management (JOHCM) is an independently managed, active investment boutique managing assets for clients worldwide across a range of global and regional equity strategies from our offices in London, Singapore, New York, Boston, Philadelphia, Dublin, Paris, Frankfurt, Zug, and Prague.

With no house view and no investment committee, our independent, fund manager-led teams invest with high conviction and full autonomy, and are able to pursue the most attractive investment opportunities whilst being free from the bureaucratic distractions of larger investment houses. Strategies are driven by small teams at a regional level to capitalise on the best opportunities, and sizes are capacity-constrained to preserve outperformance and protect client interests. Portfolio managers are dedicated to a single strategy.

Our Parent Company

In 2023, Perpetual Limited – an ASX-listed, global diversified financial services company headquartered in Sydney, Australia – acquired Pendal Group Limited, including J O Hambro Capital Management, to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

Our Core Values & Ethos

Our History

From our very first conversation to ongoing support, our teams of experts are here to answer your investment needs.